Managing personal finances can be challenging, especially when there are multiple income sources, expenses, and savings goals to keep track of. One of the most effective ways to stay on top of your finances is by creating a personal budget planner spreadsheet.

In this article, we will guide you step by step on how to create a personal budget planner spreadsheet with the following capabilities:

- 12 monthly budget tabs for every month of the year

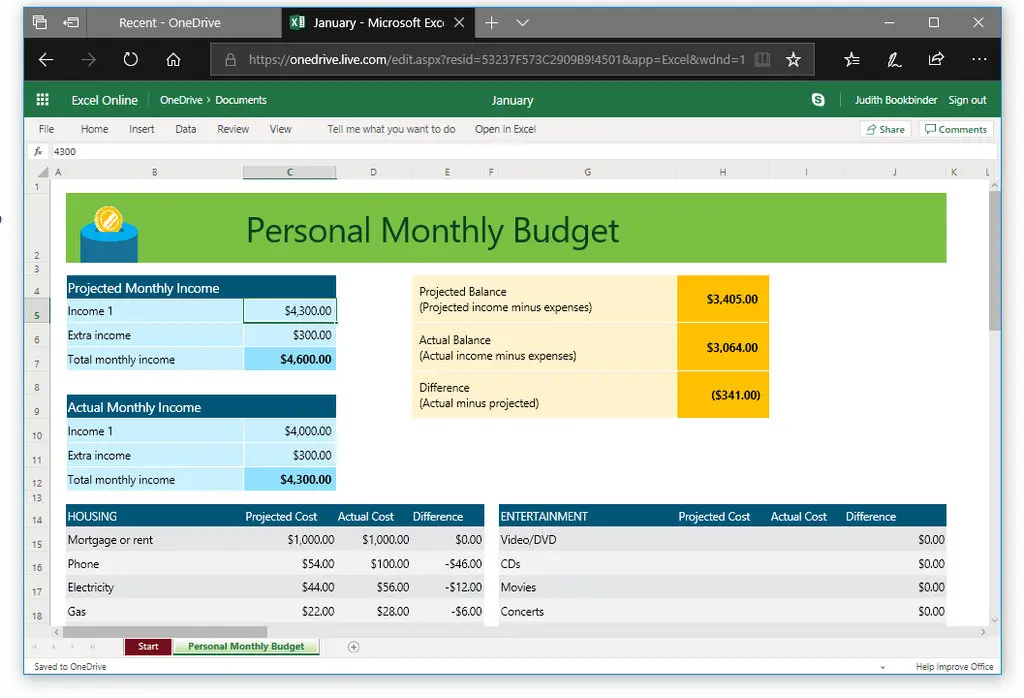

- Each monthly budget tab includes an expense tracker to track your expenses by category (groceries, transportation, utilities, etc.), income by category, debt payoffs, and savings

- Set monthly goals for Income, Expenses budget, savings, and debt payoffs. Track these goals against actuals

- Annual Dashboard tab with 9 helpful charts covering a summary of your Income, Expenses, Savings, and Debt Payoffs for the financial year

- Personalize the tracker based on your own income sources, expense types, and personal financial situation (e.g., housing loan, saving for son’s university)

Alternatively, if you want to save time, simply buy our professionally designed Budget Planner templates to kickstart your financial planning. I’ll shamelessly plug them below 🙂

Create the Monthly Budget Tabs

Open a new spreadsheet in your preferred software (e.g., Microsoft Excel, Google Sheets). Rename the spreadsheet as “Budget Planner” or any other name of your choice. You can also choose a suitable color scheme, font style, and size for your spreadsheet.

Create 12 tabs, one for each month of the year. Label each tab with the corresponding month.

Set Up the Expense Tracker

First, create column headers for each expense category you want to track (e.g. groceries, transportation, utilities, etc.). Then, create a column for the expense amount and a column for the date of the expense.

Next, you can add additional columns for any relevant notes or details about each expense. For example, you might want to note whether a particular grocery purchase was for a special occasion or if a transportation expense was for a work-related trip.

In terms of formulas, you can use Excel’s SUM function to automatically calculate the total amount spent in each expense category, as well as the total amount spent overall. You can also use conditional formatting to highlight any expenses that exceed a certain threshold or fall outside of your budget.

Set Up the Income Tracker

To track your monthly income, within the monthly tabs, add a section for you to list out each of your income sources and the amount of income you expect to receive from each source each month. You can also include any notes or details about each income source if necessary.

Set Up the Debt Payoff Tracker

To track your progress in paying off your debts, you can include a separate section on your expense tracker worksheet where you capture monthly payments made towards your outstanding debts (e.g. credit card balances, student loans, etc.) and the amount you owe for each. You can then use formulas to track your progress in paying off each debt over time.

Set Up the Savings Tracker

Lastly, within your monthly tabs, capture the amounts saved each month. They should all add up nicely – your savings are the remaining amount left over after paying for Expenses and Debt (Savings = Income – Expenses – Debt Payoffs). Set different Savings Categories depending on your goals (e.g., emergency fund, down payment on a house, vacation, etc.).

Set monthly goals

In each monthly budget tab, create a section to set monthly goals for Income, Expenses budget, Debt payoffs, and Savings. You can also add a column to track the difference between the goals and the actuals.

Create the Annual Dashboard tab

Create a new tab and label it as the Annual Dashboard. In this worksheet, create charts to summarize your Income, Expenses, Savings, and Debt Payoffs throughout the financial year. This dashboard can provide you with an overview of your finances for the year, what’s driving your Income and Expenses – and the opportunities for improvement. You can choose the types of charts that work best for you, such as pie charts, bar graphs, or line charts.

Conclusion

Creating a personal budget planner with the above capabilities can seem like a daunting task, but by following these simple steps, you’ll have a powerful tool to manage your finances and achieve your financial goals.

Remember, the key to successful budgeting is to track your income and expenses consistently and to adjust your budget as needed. By using this personal budget planner, you’ll have a clear picture of your finances and be able to make informed decisions about how to allocate your money.

If you want to save time and not create your spreadsheet from scratch, simply buy our professionally designed Budget Planner spreadsheets that are used by many others like yourself!

Comments

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.